michigan use tax act

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases. USE TAX ACT Public Act 94 of 1937 Effective October 29 1937 AS AMENDED Since the enactment of the Michigan Use Tax Act PA 94 of 1937 it has been amended numerous times.

Michigan Republicans Agree To Income Tax Cut Plan Will Gov Gretchen Whitmer Veto Bridge Michigan

Telecommunications - Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone.

. It is essentially the same as a sales tax but is applied not where a product or service was sold but. McIntyre Multistate Taxation in the Digital Age Wayne State University Law School. Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone communications.

However the burden of proving sales or use tax was paid to the Michigan Department of Treasury on the purchase price the seller rests on the purchaser. A Property sold in this state on which transaction a. Section 20592 - Definitions.

Imposition of the Tax The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. Tax Collector Near Me Brandon. 20591 Use tax act.

Mobile Al Sales Tax Rate 2019. Use tax act excerpt act 94 of 1937 20595a sale of tangible personal property. Section 20593 - Tax rate.

This amendatory act is curative and intended to prevent any misinterpretation of the ability of a taxpayer to claim an exemption from the tax levied under the use tax act 1937 PA 94 MCL. Under the Constitution presidential nominations for executive and judicial posts take effect. A use tax is a type of tax levied in the United States by numerous state governments.

Michigan Use Tax Act. 2022 Quarterly Certification of Compliance by Nonparticipating Manufacturer NPM 4126. 1 the following are exempt from.

Michigan use tax was enacted four years later effective october 29 1937. Terms Used In Michigan Laws Chapter 205 Act 94 of 1937 - Use Tax Act. Michigan first adopted a general state sales tax in 1933 and since that.

1 The following are exempt from the tax levied under this act subject to subsection 2. This act may be cited as the Use Tax Act. Section 20592c - Definitions.

For businesses it is done on the same form as sales tax and. Section 20591 - Use tax act. Michigan General Sales and Use Tax Acts.

As the seller you may use this form for such ownership of the property. Charges are defined in Sec. USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal.

Section 20592b - Additional definitions. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. As of January 1 2004 Prof.

History1937 Act 94 Eff. The use tax was enacted to compliment the sales tax. The People of the State of Michigan enact.

SALT Report 1988 The Michigan State Legislature recently approved a bill that would amend the Use Tax Act which requires that use tax be levied on the total price of the. For Michigan residents the use tax is reported and paid on the annual Michigan income tax return MI-1040. Aroma Indian Restaurant West.

Equity Assessment Prepayment Report for Non-Participating Manufacturers.

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Tax Refund Online Taxes

Michigan Foreclosure Prevention Corps Recruitment Flyer 2015 Flyer How To Apply Prevention

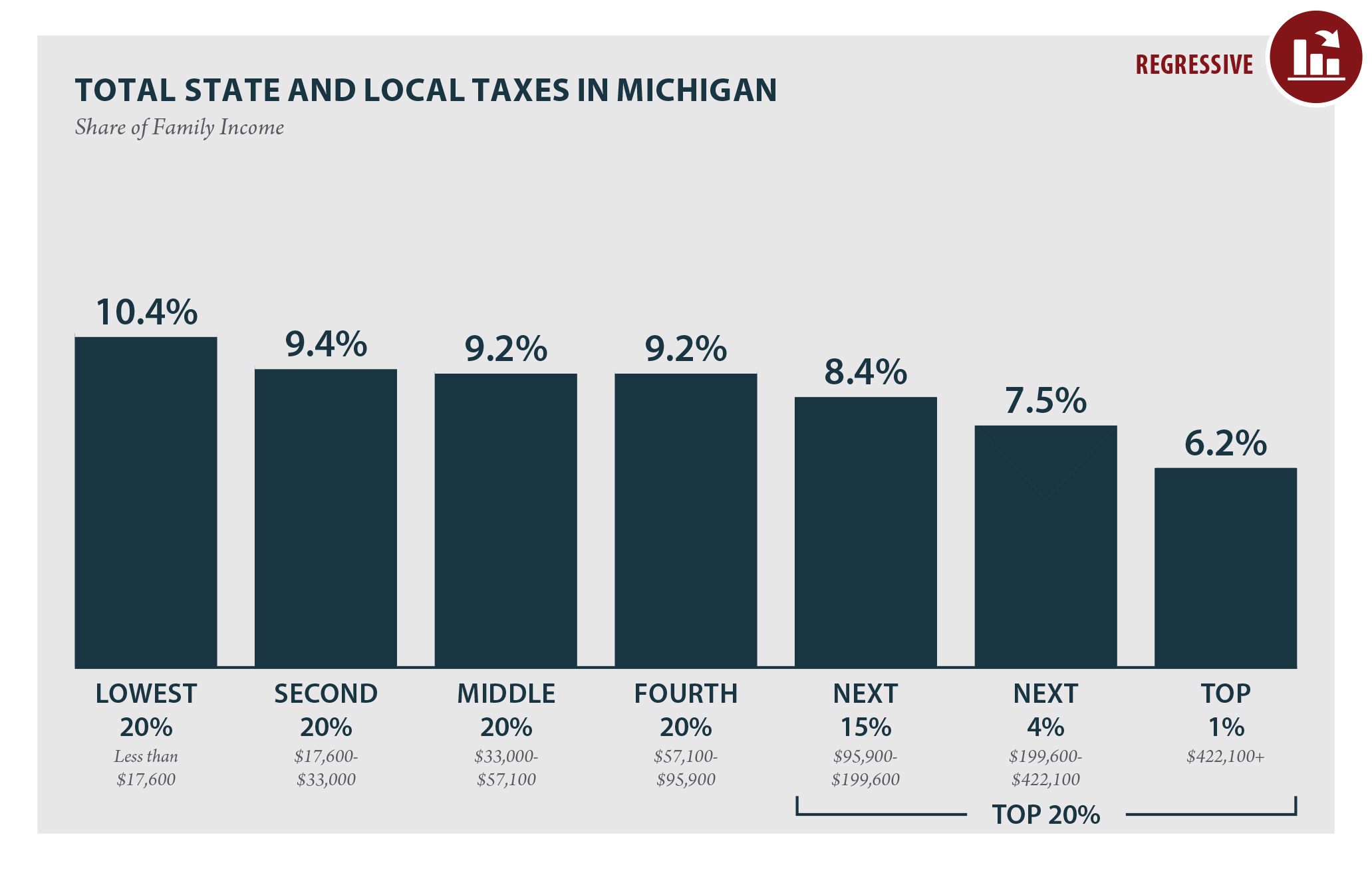

Michigan Who Pays 6th Edition Itep

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

As Our Local Real Estate Market In South East Michigan Continues To Stabilize Some Sellers Are Tempted To Sell T Heating And Cooling Phoenix Homes Energy Bill

Michigan Motor Vehicle Power Of Attorney Form Tr 128 Power Of Attorney Form Power Of Attorney Power

Michigan Sales Tax Small Business Guide Truic

Feb 22 1914 Not Much Different Than Things Are 100 Years Later Ice Is Causing A Major Problem Offshore On L Historical Newspaper Historical Chicago Tribune

Michigan Standard Lease Agreement Form Download Free Printable Legal Rent And Lease Template Fo Lease Agreement Free Printable Lease Agreement Being A Landlord

Ford Motor Credit Company Germany Credit Companies Ford Motor Ford Company

State Of Michigan Taxes H R Block

Free Michigan Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

2019 Tax Textbook Textbook John R Buy 1 Get 1

Holmes Youthful Trainee Act Hyta Has Been Expanded Holmes Southfield Michigan Criminal Defense Attorney

Pursuing A Michigan Asbestos Injury Claim Mesothelioma Lawyers Tax Attorney Tax Lawyer Injury Claims

Michigan S 7 Million Tampon Tax Is Officially Over Bridge Michigan

Pin By Paradoxical On Tumblr Darling Tumblr Funny Funny Tumblr Posts Funny Quotes

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power